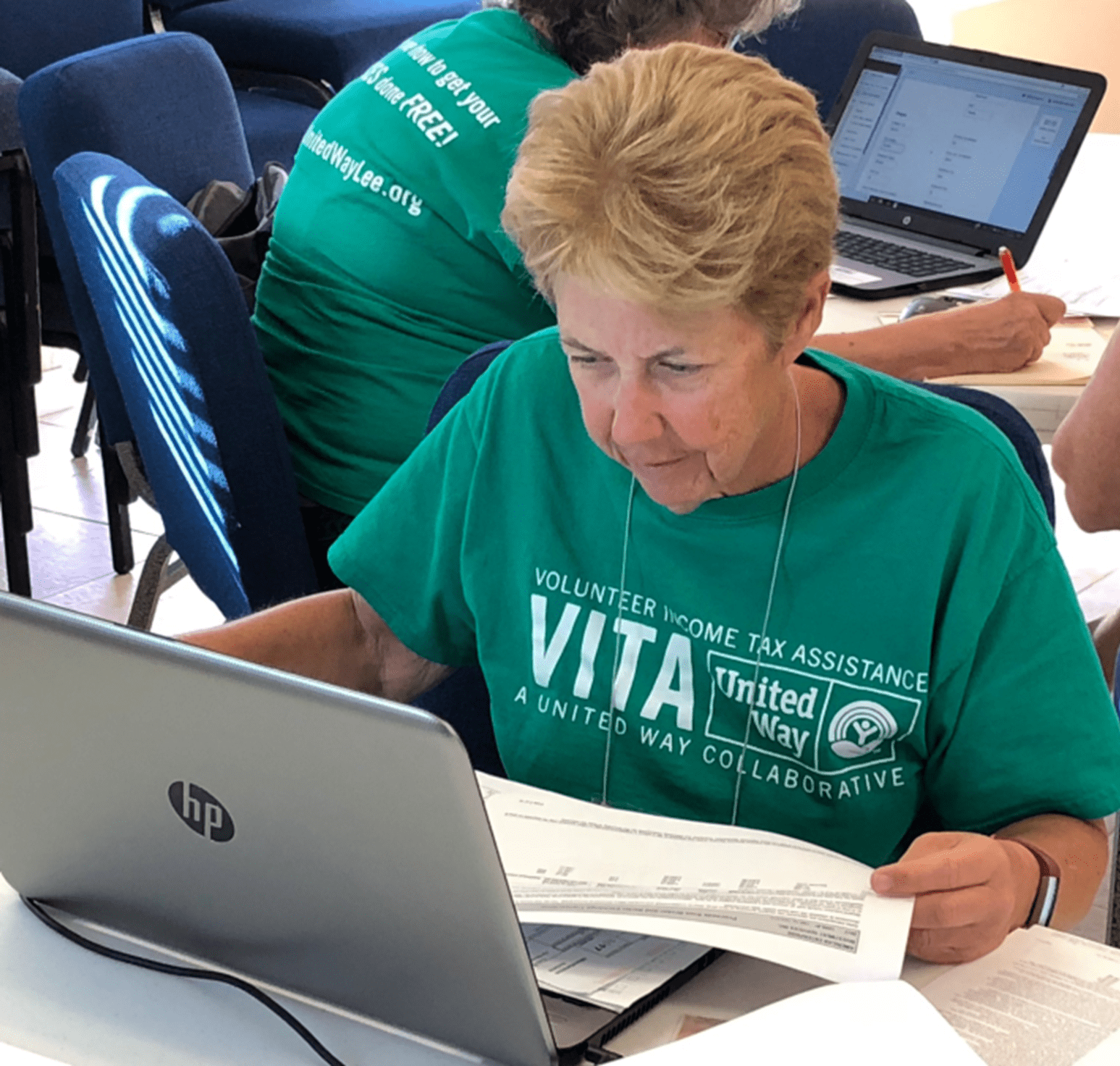

Continuing a popular service from the last several years, FISH will again host the United Way Volunteer Income Tax Assistance (VITA) Program which offers free tax preparation assistance. Eligible households must make $66,000 or less. Participating taxpayers will have their returns completed and filed for them at no cost. VITA preparers are IRS certified, trained volunteers that ensure each participant’s return is maximized by informing them of all tax credits or policies relevant to their personal tax situation.

Beginning Fri., Feb. 4, VITA will offer tax preparation service at the FISH Palm Ridge location — 2330 Palm Ridge Road, #16, Sanibel, next to Island Pharmacy, from 9:00a-1:00p. Appointments are required. During the appointment, an intake, tax return preparation and quality review will be conducted. Upon completion, the return will be filed on-site with the preparer. Individuals should plan for an approximate one-hour appointment. Additional appointment dates are February 11, 18 and 25; March 11 and 25; and April 8 from 9:00a-1:00p.

For those with time constraints, documentation may be dropped off on Feb. 11 and 18 between 4-6p. The documentation will be taken to Fort Myers for return preparation and returned to Sanibel for pick up on the following Friday at the Palm Ridge location.

Those wishing to have their tax return completed through the VITA Program must bring the following documentation, if applicable. Tax returns cannot be completed without all of the items listed below:

Additional information, such as interest and dividend statements, previous year’s tax return, student loan information, etc. may be requested by VITA preparers.