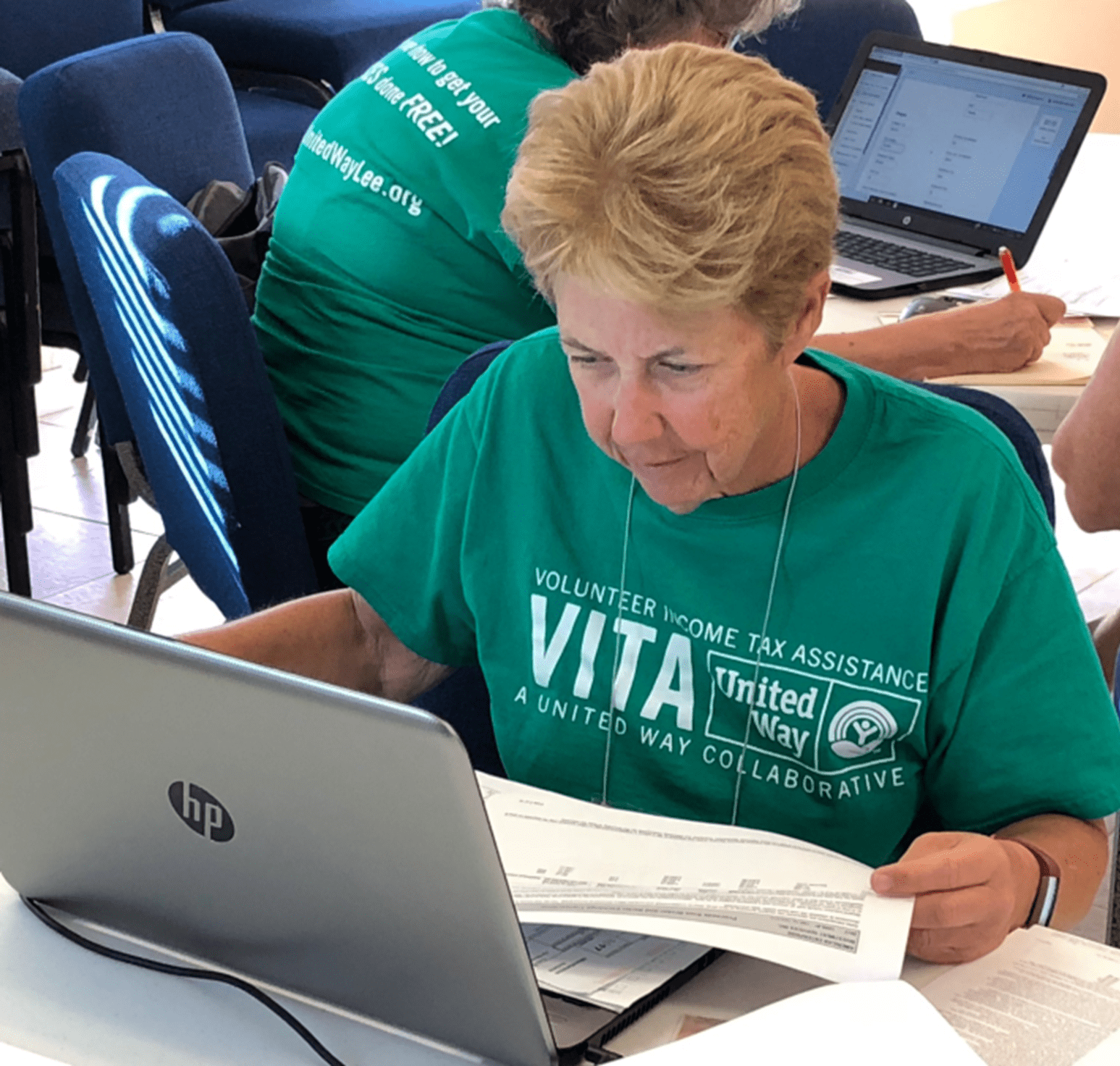

Continuing a popular service from the last several years, FISH will again host the United Way Volunteer Income Tax Assistance (VITA) Program which offers free tax preparation assistance. Residents who earn a household income of $66,000 or less can have their federal tax returns prepared, e-filed and direct deposited for FREE by United Way’s Volunteer Income Tax Assistance (VITA) program.

United Way IRS-certified volunteers who are passionate about taxes will prepare your return and determine if you are eligible for the Earned Income Tax Credit (EITC), Child Tax Credits, Childcare Credits and/or Education Credits when you file.

VITA prepares simple returns. They cannot prepare returns that have rental income; or self-employment income at a loss, with expenses that exceed $35,000, or with employees. Please call to see if you qualify.

Beginning Fri., Feb. 2 and continuing every other Friday through Apr. 12, VITA will offer tax preparation service at Sanibel Public Library, 770 Dunlop Road, from 10:00a-2:00p. Appointments are required and can be made by scheduling online at https://www.unitedwaylee.org/freetaxprep/. Interested individuals may also dial 2-1-1 or call 239-433-3900 to schedule an appointment.

Those wishing to have their tax return completed through the VITA Program must bring the following documentation, if applicable. Tax returns cannot be completed without all of the items listed below:

Additionally, if residents paid real estate tax on their home, bring the paid receipt. This is deductible even if taking the standard deduction. For those itemizing deductions, please bring a summary listing of deductions and supporting details/receipts. For those taking college courses to further education for a job, and you paid the tuition, please bring the tuition receipt and any financial aid or student loan statements.

To have refunds deposited into a checking or savings account, bring account details (a check assigned to the specific account). To learn more about the VITA program, please contact Erika Broyles at FISH, 239-472-4775.